Travel Insurance

Travel insurance can provide peace of mind while traveling, knowing that you have financial protection in case something goes wrong during your trip.

It can provide coverage and financial protection for unexpected events that could disrupt or impact your trip, such as trip cancellation or interruption, medical emergencies, or lost or stolen luggage.

In addition, travel insurance can provide coverage for emergency medical expenses while you're abroad, which can be especially important if you're traveling to a country where medical care is expensive or not easily accessible.

If you're traveling to a destination with a higher risk of natural disasters or political unrest, travel insurance can provide coverage for trip interruption or cancellation due to these events.

While travel insurance is not mandatory for all trips, it is highly recommended, especially for international travel or trips involving significant costs or risks. It's always a good idea to carefully review your travel insurance policy to understand what's covered and what's not.

TRIPMATE TRAVEL INSURANCE

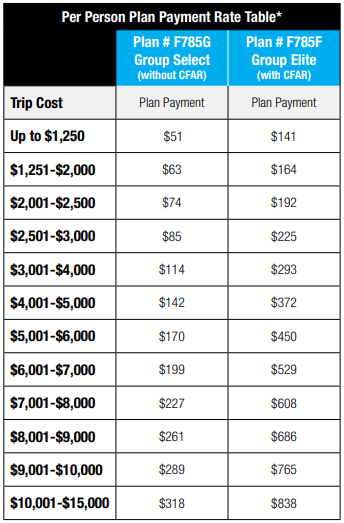

The insurance premium is due at time of deposit. Currently, covered reasons are up to 100% reimbursable, non-covered up to 75% reimbursable. However, no representation or description of the insurance made by Timeless Travels to you, constitutes a binding assurance or promise about the insurance. Timeless Travels is not an insurance company and has no responsibility for the submission, payment or adjustment of any insurance claims. Any insurance claims that may fall under the relevant travel insurance policy must be submitted to the insurance company identified in the policy. Please contact Tripmate Insurance for more specific details.

Tel: 1-844-207-1929 | POLICY BROCHURE

NOTE: Rates above are for 2024 travel, and may be subject to change for 2025.

Group Select (without CFAR) coverage is only available for NY residents and is also the only coverage available for NY residents. Non NY residents will be quoted the Group Elite (with CFAR) coverage.